Payroll paycheck calculator

Ad Learn How To Make Payroll Checks With ADP Payroll. Get 3 Months Free Payroll.

Hourly Paycheck Calculator Template Google Docs Google Sheets Excel Word Apple Numbers Apple Pages Template Net Paycheck Templates Calculator

It will confirm the deductions you include on your.

. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. All other pay frequency inputs are assumed to. Actual rent payment 10 of salary.

Federal payroll tax rates for 2022 are. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly.

Everything You Need For Your Business All In One Place. Take a Guided Tour. Get a free consultation with one of our experienced Wage Attorneys.

To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. 15000 10 50000 10000. The state tax year is also 12 months but it differs from state to state.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. 50 of Basic salary metropolitan city 50 50000 25000. Specifically Built For You.

Starting salary for a GS-12 employee is 6829900 per year at Step 1 with a maximum possible base pay of 8879200 per. Ad The Best HR Payroll Partner For Medium and Small Businesses. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Need help calculating paychecks. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

Get an accurate picture of the employees gross pay. Ad Learn How To Make Payroll Checks With ADP Payroll. Next divide this number from the.

Get 3 Months Free Payroll. Ad Compare This Years Top 5 Free Payroll Software. Fast Easy Affordable Small Business Payroll By ADP.

This component of the Payroll tax is withheld and forms a revenue source for the Federal. Some states follow the federal tax. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

It comprises the following components. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your. Free Unbiased Reviews Top Picks.

Least of the above amounts. Federal Salary Paycheck Calculator. Get 3 Months Free Payroll.

The adjusted annual salary can be calculated as. How do I calculate hourly rate. HVAC Plumbing Electrical Garage Roofing More.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and. Hourly Paycheck and Payroll Calculator. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Discover What you are Owed and Get the pay you have earned. Important Note on Calculator.

Fast Easy Affordable Small Business Payroll By ADP. Computes federal and state tax withholding for. Important Note on Calculator.

Ad Run Easy Effortless Payroll in Minutes. Ad Housecall Pro The 1 rated app for home service companies. Paycors Tech Saves Time.

Book a free demo today. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Components of Payroll Tax.

Get 3 Months Free Payroll. Taxes Paid Filed - 100 Guarantee. Salary Paycheck and Payroll Calculator.

For example if you earn 2000week your annual income is calculated by. Approve Hours Run Payroll in App. The rates have gone up over time though the rate has been largely unchanged since 1992.

Calculating paychecks and need some help. Our Expertise Helps You Make a Difference. Social Security tax rate.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general.

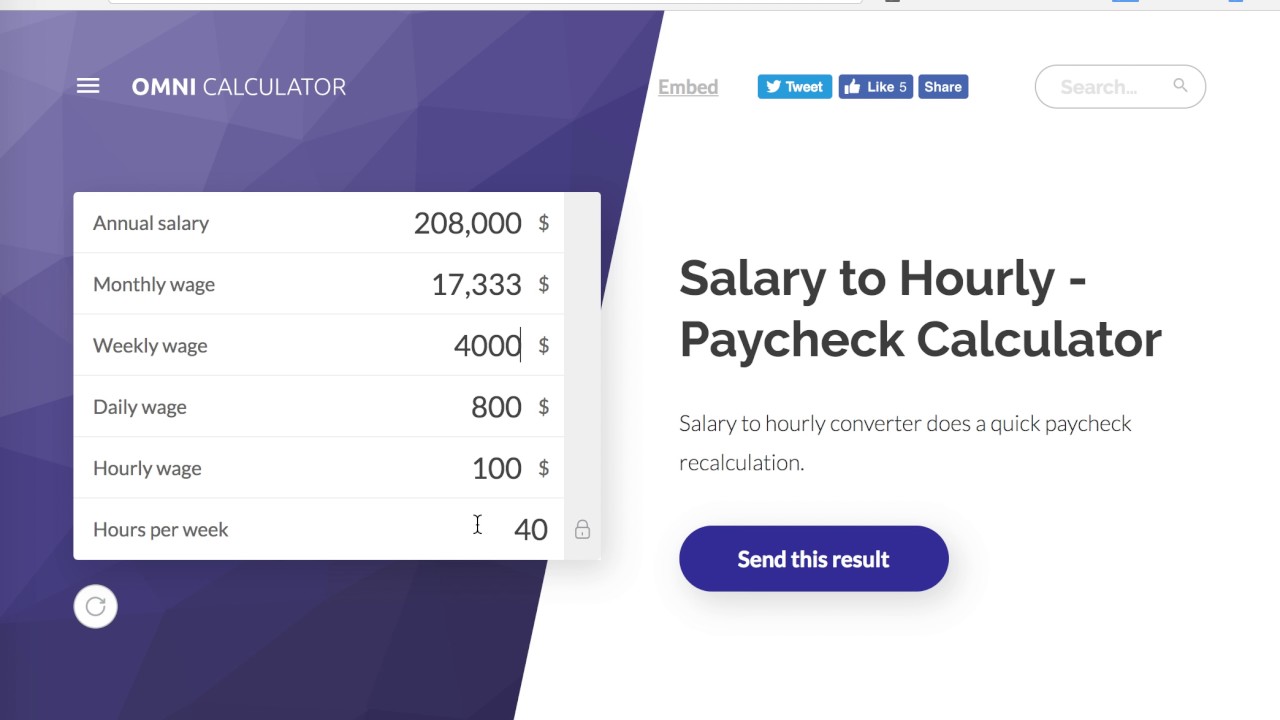

Salary To Hourly Paycheck Calculator Omni Salary Budget Saving Paycheck

Hourly Paycheck Calculator Try Our Free Paycheck Calculator Download Salary Paycheck Calculator To Your Site Paycheck Business Tutorial Payroll

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Formats Samples Examples

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Excel Good Essay

Make A Paystubs By Using Free Online Pay Stub Maker It Is Also Best Paycheck Calculator Which Can Easily Good Essay Best Essay Writing Service Essay Generator

3 Free Pay Stub Template With Calculator Payroll Template Life Planning Printables Spreadsheet Template

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Templates Paying

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

Hourly Paycheck Calculator Hourly Payroll Calculator Payroll Paycheck Calculator

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Salary Paycheck Calculator Take Home Pay Calculator Paycheck Calculator Pay Calculator Love Calculator 401k Calculator

Salary To Hourly Salary Converter Omni Salary Paycheck Finance

Pay Check Stub Payroll Checks Payroll Payroll Template

With Free Pay Stub Generator You Can Make Free Paycheck Stubs And Can Get A Chance To Make 1st Stub Free Giv Printable Checks Payroll Checks Payroll Template